52ND ANNUAL CONFERENCE, Bali, Indonesia, 24-28 April 2013WP No. 160Update on Commercialisation of Air Traffic ServicesPresented by PLC |

Summary

This paper compiles information about the impact of commercialisation of Air Traffic Services on the working environment of ATCOs in several countries and regions.

Introduction

1.1 With the advent of the “new public management“ trends and the increased willingness by governments to bring forward the idea of commercialisation of airport and Air Navigation service providers, the Member Associations of IFATCA together with the Executive Board have started to assess the impact on the MA. This has led to the current IFATCA policy.

1.2 IFATCA has observed in the last 15 years a move from government owned Air Navigation Service organisation towards more corporatised organisations. This trend or fashion started in the late 80’s as more pressure resulted from the liberalisation of the aviation domain. Depending on the culture, political situation and importance of the aviation sector different models have been chosen to “commercialise” Air Traffic Control. There is no guideline how best to do it. It is important to note that IFATCA has a neutral position in this matter and has no preferred model.

1.3 This paper will provide an update on commercialisation across states considering the information provided by several IFATCA Member Associations and other sources.

Discussion

2.1 IFATCA policy

2.1.1 WC 1.2.2.6 MONITORING PRIVATISATION / COMMERCIALISATION IN ATC

2.1.1.1 The 1993 Conference adopted the following definition of Privatisation for IFATCA use: Privatisation of Air Traffic Control refers to the process by which the functions and/or assets of Air Traffic Control are transferred from a government department to either the private sector or to a Company or Corporation owned either partly or fully by the government, but operating independently of total government control. [Coopers & Lybrand].

IFATCA Policy is:

2.1.1.2

| The safety and quality levels of the Air Traffic Services system shall not be compromised by privatisation/ commercialisation.

See: WP 111 – Christchurch 1993 |

2.1.1.3

| IFATCA should monitor the effects of privatisation/ commercialisation on ATCOs working conditions in co-operation with the ILO.

See: WP 111 – Christchurch 1993 and Resolution C10 – WP 164 – Punta Cana 2010 |

Note: A comprehensive overview of legal aspects that should be considered the minimum requirements when ATC is to be privatised can be found in WP 94.C.137 which was accepted as Guidance material by Rec. 94.C.21.

2.1.1.4

| IFATCA creates and maintains a secure database from responses to the questionnaires.

See: WP 157 – Marrakech 2000 and Resolution C11 – WP 164 – Punta Cana 2010 |

2.2 The human capital

2.2.1 At most federal agencies, the lion’s share of operating costs is devoted to the workforce. For this reason, employees traditionally have been viewed through the budgetary lens, and therefore they have often been seen as costs to be cut rather than as assets to be valued. However, high- performance organisations in both the private and public sectors recognize that an organisation’s people largely determine its capacity to perform.

2.2.2 Simply stated, human capital means people. There are, however, two key principles that are central to the human capital idea. First, people are assets whose value can be enhanced through investment. As with any value of people increases, so does the performance capacity of the organisation, and therefore its value to clients and other stakeholders.

2.2.3 Second, an organisation’s human capital policies must be aligned to support the organisation’s “shared vision”—that is, the mission, vision for the future, core values, goals and objectives, and strategies by which the organisation has defined its direction and its expectations for itself and its people. All human capital policies and practices should be designed, implemented, and assessed by the standard of how well they help the organisation pursue its shared vision.

2.2.4 These organisations understand that the value of the organisation is dependent on the value of its people. Enhancing the value of employees is a win-win goal for employers and employees alike. The more an organisation recognizes the intrinsic value of each employee; the more it recognizes that this value can be enhanced with nurturing and investment; the more it recognizes that employees vary in their talents and motivations, and that a variety of incentive strategies and working arrangements can be created to enhance each employee’s contributions to organizational performance, the more likely the organisation will be to appreciate the variety of employee needs and circumstances and to act in ways that will make sense in both business and human terms.

2.3 Commercialisation of ATS in Europe: information about UK, Ireland, Germany, Sweden and Spain.

2.3.1 Since the late 80s the change process in Air traffic management was nearly a constant one. Fundamental aspects are to be taken into consideration when facing commercialisation or privatisation of air navigation services, such as institutional, regulatory, financial, human and legal issues (“Restructuring of Air Navigation Services”, by Marc Baumgartner. Published in the Turkish Air Traffic Controller Association ́s publication “Scope”, October 2003). At present, several privatisation processes are being carried out throughout Europe, Sweden and Spain being an example of that. Spain will be shown as a case study of the direct consequences of commercialisation processes on ATCOs.

2.3.2 Single European Sky

2.3.2.1 Driven by operational, political or institutional needs or motivation, constant changes have affected members of IFATCA on a global level, for the past 3 decades. Since 1999, pressure on the European Commission to improve the ATS system raised. The continuous increase in air traffic flow, the perceived fragmentation of the European air services and the saturation of the capacity of many airports were decisive factors to launch the Single European Sky concept (SES). Several regulatory packages promoted the creation of a Pan-European air space, laying down a harmonised regulatory framework on the provision of air navigation services, on the creation of functional airspace blocks, on the creation of a European Agency Supervisory Authority (EASA), as well as on the creation of National Supervisory authorities, the SESAR technological programme, and etc.

2.3.2.2 Under the SES II, a performance based approach forces each member state under the SES to contribute with national targets to the overall European target. Coupled with the changed charging regime this has considerably increased the pressure on the ANSPs and the states to reduce costs and increase the service quality (capacity/delay) which for some ANSPs has a tremendous impact on the delivery of the service. The SES is typically a liberalisation agenda.

2.3.3 The UK Model

2.3.3.1 In UK, NATS Holdings Limited (formerly National Air Traffic Services Limited) is the main air navigation service provider in the United Kingdom. It provides en-route air traffic control services to flights within the UK Flight Information Regions and the Shanwick Oceanic Control Area, and provides air traffic control services to fifteen UK airports and Gibraltar Airport. The current shareholders in NATS are: the UK Government (49%); The Airline Group (42%) which is a consortium of British Airways, BMI, EasyJet, Monarch Airlines, Thomas Cook Airlines, Thomson Airways and Virgin Atlantic; BAA Limited (4%); and NATS employees (5%).

2.3.3.1.1 A 2008 study conducted by the “Economic Regulation Group” (ERG) dependent on the “Civil Aviation Authority (CAA)” looked at the “contestability” of the market of Air Navigation Service Providers at control towers.

2.3.3.1.2 Historically, each airport supplied the provision of its own Tower ATC service. However, after its creation in 1972, NATS expanded and begun serving the major airports of the UK. In the late 90s the market opened to allow the certification of ANSPs, which started providing ATC services at control towers.

2.3.3.1.3 Of the 67 certified providers in the UK in 2008, only NATS, SERCO and two government agencies provided service to others. The rest provided their own ANS on a self-supply basis. Safeskyes has been recently certified as a provider, but it only operates at a very small airport (North Denes).

2.3.3.1.4 This study and its conclusions were the result of a series of meetings held by the ERG with airports and service providers. The main conclusions were as follows:

- The UK airport sector is highly competitive. Airports are close to each other and have a mix of ownership structures (although most of them are private). They compete to attract passengers and airlines and this competition is also applied to costs, including control tower costs.

- The costs for the provision of control tower services range between 4.5% and 6% of total operating costs (what we know as aeronautical costs). For instance, Heathrow’s tower ANS costs are 5.9% of total operating costs, Gatwick’s are 5.8% and Manchester’s are 4.6%. Therefore, these costs constitute a relatively important item, which is subject to budget cuts.

- Airport operators recognise that they often consider changing providers, they periodically ask for both external and internal reports in order to pick the best option.

- In view of the risks associated with the change of providers, airport operators should have a very clear idea about the potential advantages of transitioning to a new service provider, and they should be absolutely certain that the benefits will outweigh the possible drawbacks.

2.3.3.2 Objective facts about the liberalisation process in the UK. (Data: 2008)

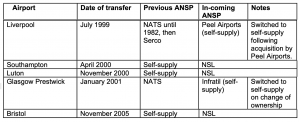

As of 2008, NATS (NSL) provided control tower services at the top 11 UK airports (by air traffic movements). Of the top 30 UK airports (by air traffic movements), 14 were managed by NATS (NSL), 15 self-supplied the provision of their ATC services, and only 1, Scatsta Airport (EGPM), in the Shetland Islands (north of mainland Scotland), was managed by SERCO.

From 1997 to 2008, the changes of ANSPs in those 30 airports were as follows:

In summary:

- Two airports (Glasgow and Liverpool) switched to self-supply of ANS due to change of ownership to new airport companies which already provided the same service at other airports.

- Two airports (Southampton and Luton) went from self-supply of ANS to hiring NATS (NSL) as their provider.

- SERCO ceased operations in Liverpool.

- We found no cases where all the ATCOs in a control unit were replaced when switching providers. In order to make transition periods easier, the UK legislation safeguards the working conditions of employees in the event of a change of employer.

2.3.3.3 Aerodrome control is a “complex” service which cannot be easily outsourced. Most airports will rather entrust its provision to a semi-public company such as NATS (which is 49% owned by the British Government), a public private partnership formed by the Government and a consortium of airlines, which will not focus exclusively on profit. The State does not have an interest in NATS as a funding source. Also, the main activity of the rest of shareholders (British Airways, Ryanair, Lufthansa, Ferrovial, and so on) is not managing tower control services, but they are all genuinely interested in obtaining a reliable and quality service so they can carry out their core activities smoothly (e.g., they want no delays).

2.3.3.4 The fact that SERCO only operates the second-to-bottom airport in the list of the 30 top UK airports, and Safeskyes operates none is revealing. It is clear that airports do not seem to want to outsource such an essential and skilled service exclusively for profit.

2.3.3.5 NATS has recently re-structured along 6 service lines; Airports, Airspace, Engineering, Defence, Information and Consultancy. It currently holds the monopoly of civilian en-route air traffic control over the UK and is regulated by the CAA who determine the charges that can be made. This regulated part is funded by charging airlines for the provision of air traffic services. It also has a non-regulated part, which competes for contracts in the free market to provide air traffic control at airports in the UK and overseas. Additionally NATS is focusing on providing consultancy, engineering, technical and education services in fields related to air traffic control.

2.3.3.6 Staffing levels have reduced over the years since the public private partnership began, and efforts have been concentrated on reducing costs within the business, although there is no evidence to suggest that this is a direct result in the change in ownership. The reduction in costs has been primarily driven by reducing head count and efficiencies, rather than in reduced salaries. Additionally however with the expansion of the non- regulated part of the business, new openings have been created particularly in the consultancy area of the business. This expansion is intended to increase NATS’ turnover which is not possible within the regulated part of the business. There are concerns that pensions may be at risk due to financial concerns after the financial market collapse and the requirements to perform to E.C. RP2 targets.

2.3.4 Ireland

2.3.4.1 Prior to January 1, 1994 Irish ATC service was provided by Aero Nautical services Office (ANSO), a section of the Department of Transport of the Irish Government, and salaries an employment conditions were dictated by Civil Service norms.

2.3.4.2 Because of restrictions at the time there was no method of raising funds for new equipment unless sanctioned by the Department of Finance, user charges went straight into Government revenue. Recruitment of new staff was limited due to an embargo and only 1 vacancy in 3 was filled.

2.3.4.3 On January 1, 1994 a new “Commercial Semi- State” company was formed: the IAA. This new entity would get the revenue from user charges and would also be able to borrow for new equipment against this revenue stream. Staff shortages could now be addressed.

2.3.4.4 By entering a collective agreement with the company, Irish ATCOs were able to sever the salary link to the former Civil Service and yet retain the terms and conditions of all staff in the company prior to the creation of IAA. All staff hired after January 1, 1994 were on personal contracts that reflected these terms and conditions, with one exception, loss of licence. Significant recruitment of new staff took place, to permit extra airspace to be served, NOTA and SOTA. As a consequence of that, new buildings and modern equipment was purchased, and the salary of the Irish ATCO increased by around 30% compared to their former grade over a 15 year period.

2.3.4.5 However, after about 5 years, company management took a more aggressive stance in their dealings with Union representatives, and this more hardline stance was taken against people who had competence issues. When the ATCOs pension fund had a serious deficit the company position was clearly one of not to contribute any more. This issue was addressed by negotiation whereby all staff and the company would contribute more until the end of 2018.

2.3.5 Germany

2.3.5.1 The provision of the tower ATC service in Germany has been partially opened. The public company DFS will still provide services to the 16 top airports of the country for a period of 16-20 years, but the provision of the service in regional airports has been opened to other providers.

2.3.5.1.1 The starting point was the creation in December 2005 of a low-cost subsidiary of DFS, called “The Tower Company”, to provide tower control service in regional airports at more competitive prices.

2.3.5.1.2 Since that year, several other ANSPs have been certified in Germany: mainly, “Austrocontrol”, Airbus, Thales, and three regional airports.

2.3.5.1.3 In 2007, several regional airports went through a bidding process for the tower control service, which was awarded to “Austrocontrol” in 10 of those airports, and to “The Tower Company” in 9 airports. Three other airports were certified as service providers. In July 2012, “Austrocontrol” will also start operating in the regional “Schwerin-Parchim International Airport.

2.3.5.1.4 It is important to note that the ownership structure of German airports is highly diversified: from mixed public-private participation (as in Dusseldorf and Hamburg airports), to companies listed on the stock exchange, whose main shareholders are regional Governments (as in Frankfurt airport, which is serviced by Fraport, a society that is 31.5% owned by the State of Hesse), and airports that belong to the landers (mainly regional airports), etc.

2.3.5.2 Conclusions of the German case:

2.3.5.2.1 The objective is creating a market for aviation service providers, where only two public companies compete: a subsidiary of DFS (which is 100% owned by the German State), and Austrocontrol (which is 100% owned by the Austrian State).

2.3.5.2.2 In the case of Germany, DFS (ANSP) was privatised in 1993, but until now it is 100 per cent Government owned. . With privatization the ATCO ́s salaries were raised by at least a third. And also the benefits of the former collective agreements were taken over (for example early retirement). At the same time, DFS started a feasibility study to consolidate the number of air traffic control centers, and from that process the result was the integration of all approach service units in lower airspace centers. ATC for upper airspace is only provided from Rhein Radar today. A lot of ATCOs had to change location and most of them were not really enthusiastic about that even if DFS paid them a lot of money for going from one place to another. There were many doubts about the benefits of this measure. And most ATCOs loved to work as TWR/APP controller which is not possible in Germany anymore.

2.3.5.2.3 After 2003 or 2004 DFS started to work on further privatisation. Because of that, hiring of new ATCOs was reduced to less than ten per year. The result was a significant shortage of ATCOs. To get the correct number of ATCOs is not expected until 2016. Also the number of technicians has been decreased. Additionally they have been faced with constant restructuring. There is also a fear regarding a buy-out of certain parts of technique. But that is more related to SES and FABEC than to privatisation

2.3.5.2.4 In summary:

- With privatisation the collective agreements have been improved;

- Workload for most ATCOs has increased;

- No restrictions in regard to safety or SMS;

- Privatisation itself is neither bad nor good. A private company has more freedoms to decide in relation to investments and changes in management and seems to be more flexible. For the interests of ATCOs it is important to have a strong trade union behind them and also strong worker councils within the company.

2.3.6 Sweden

2.3.6.1 At present, all Control Zones and Terminal Areas in Sweden are subject to the free market, except Stockholm TMA, Gothenburg TMA, Ostgota TMA and Malmoe TMA, which will be no later than January 1st 2015. In other words, all airspace below FL95 will be subject to free market by that date.

2.3.6.2 Control Zone Areas and TMAs belong to every airport and the Company in charge of it. As a consequence of environmental restrictions and the obligation to comply with them, it is the service provider who has the responsibility to provide ATC service within the airspace adjacent to the airport. Flight level 95 and above is not subject to the free market at present and nothing indicates that it will be in the future.

2.3.6.3 If there is a change of ANSP at an airport, then this process is strongly regulated by Swedish and European law. EU Directive 2001/23 regulates both obligations and rights of ATCOs and ANSPs in such a transition. It limits the maneuvering room of the new provider regarding layoffs for financial gain, and, for instance, it establishes that wages should be protected for a certain period of time.

2.3.6.4 The financial proposal offered by the new provider must cover job security for all existing staff during the length of the existing agreement or for a period of time decided by the regulator, which should not be less than one year. The law also establishes that the workers’ responsibilities which have been agreed upon with the previous company should continue in force. It is the responsibility of the new provider to inform all employees of their rights, obligations and time of transition. This may be conducted directly or via the union representatives.

2.3.6.5 In the case of LFV, who has emerged as the dominant player in the Swedish market, further regulations apply stipulating that, in case of ANSP transition, LFV is not allowed to offer alternative posts until ATCOs have had a chance to reject the offer from their ́new ́ employer. In practice, this means that there are no job guarantees for an employee who chooses to reject the offer. However, all ATCOs who have rejected an offer from the ACR ANSP in Sweden have been relocated within LFV or offered early retirement. This regulation is actually hindering the transition to free ATC market.

2.3.6.6 According to the Chicago Convention, it is a governmental responsibility to provide air traffic control service in National Airspace.

According to ICAO Doc 9082:

“when considering the commercialization or privatization of airports and ANSPs, bear in mind that the State is ultimately responsible for safety, security, and, in view of the potential abuse of dominant position by airports and ANSPs, economic oversight of their operations”.

2.3.6.7 It seems clear that, in the event of irregularities that could result in safety issues, LFV could be ordered to provide a solution, although, at present, this fact is not fully clarified and interpreted by Swedish law.

2.3.6.8 The Swedish ́Luftfartslagen ́ (Aviation Law) establishes that it is the Government who should decide upon the entity responsible for issuing certificates to ANSPs, but it does not specify the requirements to obtain such a certificate. For this, we have to turn once again to the EU law, more precisely to EU Regulation 1035/2011, which specifies certain requirements that ANSPs should meet in order to be certified by the national regulator.

2.3.6.9 The two ANSPs that now operate in Sweden recruit their employees through advertisements. ACR has publicised job positions in the internet, while LFV’s job recruiting processes are currently being advertised only within the company. The reason for this is that LFV fully finances the instruction of new controllers with the purpose to employ them at the end of their training, through the Nordic School, Entry Point North, which is co-owned by LFV, Naviair and Avinor.

2.3.6.10 In 2012, a report titled “SOU 2012:27” was published on behalf of the Swedish Government to further examine the role of LFV in the future of ATC in Sweden. This report proposed that LFV ́s deregulated operations should be completely separated both organizationally and financially from its closed operations. In summary, it concluded that the non-competitive side of LFV may consist mainly of en route air navigation services and local air navigation services for military airfields, infrastructure, contingency planning, research and development, as well as other public administration tasks. Also, it was proposed that operations within the Terminal business area and any other deregulated operations in other business areas be corporatised no later than 1 January 2015.

2.3.6.11 The Swedish Government will have to decide on multiple options of this privatisation process in the near future. More specific decisions are expected in all aspects of ATC and a precise indication of the politicians ́ views about LFV should be presented.

2.3.7 Spain as Case Study

2.3.7.1 In Spain, the Law 9/2010 (April 2010) has regulated the privatisation of the provision of air navigation services to airports. It has opened the market for new certified air navigation service providers to compete, under certain conditions, for the provision of air navigation services at some airports. It also stated that AENA should submit to the Spanish Ministry of Development the safety studies necessary to identify the airports which were eligible to implement the AFIS service.

2.3.7.1.1 By means of the Royal Decree 13/2010 (December 2010) AENA, the Spanish ANSP, was divided into two different companies: one for the provision of air navigation services and another one for managing all airports. In December 2010, the Ministerial Order FOM/3352/2010 established the airports whose air navigation services were going to be privatized: La Coruña, Alicante, Fuerteventura, Ibiza, Jerez, La Palma, Lanzarote, Cuatro Vientos, Melilla, Sabadell, Sevilla, Valencia and Vigo. At present, four airports provide AFIS service in Spain: Burgos, La Gomera, Huesca and El Hierro.

2.3.7.1.2 Ferronats, Saerco and Ineco are the new ANSPs who are also certified as training providers. Three more ANSPs have been recently certified. Ferronats is a new company co-established by Ferrovial, an important Spanish construction company, and NATS, the main British ANSP. Saerco is a company formed by a recently created national company, and a partnership with ANS CR, an air navigation service provider in the Czech Republic. Ineco is a Spanish engineering services company, partially owned by the Spanish State, and it is providing both ATC and AFIS services at El Hierro airport, and apron services at Barajas airport.

2.3.7.2 El Hierro airport and the issue of the European license

2.3.7.2.1 El Hierro is the smallest of the Canary Islands. El Hierro airport is small but necessary for local residents and for tourism purposes. It was also one of the first airports that the Spanish Government declared suitable to implement AFIS. As a result, AENA ́s ATCOs were replaced by AFIS operators.

2.3.7.2.2 Local politicians did not agree with this decision because they thought it was a “downgrading” of the airport, which could have an impact on tourism and on the economy of the whole area. Members of the local political party succeeded in their negotiations in the Spanish Parliament and they managed to “regain” the ATC service for the El Hierro airport. However, the Spanish Government did not want to step back in front of the public eye, and decided to combine both AFIS and ATC services. By then, AENA’s ATCOs were not available anymore at El Hierro, so the AFIS operators received “an intensive” ab-initio training course and obtained a valid full ATC license. The result is that, at present, the same staff performs AFIS functions during weekends and operates as ATCOs during the week.

2.3.7.3 The Apron Management Service at Barajas Airport

2.3.7.3.1 According to Royal Decree 1238/2011, of September 30 2011, regulated the apron management service as mandatory in airports with more than 250.000 movements, that is, Madrid and Barcelona airports. This regulation was published on the 30th of September 2011, and the first stage of this implementation was in force in Terminal 4, by the 23rd of November 2011.

2.3.7.3.2 It is important to note that the apron service management operators received just twenty days training for this purpose, and since then, they have been facing LVPs and managing multilateration and SMR radar systems with no specific training for it.

2.3.7.3.3 Another of the operational consequences of the deployment of the new service is that two of the principal taxiways, A and M, have been divided into two different areas: one which is considered as “taxiway” and another which is considered as being a part of the apron. This subdivision is causing daily safety incidents because of the increase in the number of coordination procedures between the air traffic controller and the apron operator.

2.3.7.3.4 However, the most serious consequence of this process is that the frequency which is dedicated to the emergency services of the airport, is shared among three different offices: Tower, Apron Terminal 4 and Apron Terminal 123.

2.3.7.4 Spanish scenario

2.3.7.4.1 With the objective of privatising air navigation services and, as a result, reducing air transport service costs, Spain is currently adopting the UK model.

2.3.7.4.2 One of the justifications brought up by the former Government and AENA was the high cost of ATC services and “the low productivity of Spanish ATCOs” compared to the European average. However, the data that AENA provided to Eurocontrol were not accurate. For the calculation of Spanish ATCOs productivity, all airports were included, even those with less than 50,000 yearly movements, as well as all licensed ATCOs, not only those performing operational tasks, as should have been the case. In March 2009, 1,855 of a total of 2,397 Spanish ATCOs were in OPS.

2.3.7.4.3 Several Spanish National newspapers published that “AENA distorted ATCOs productivity data in 2010” (ABC newspaper, by Javier Chicote on April 30 2012). Disclosed emails between AENA top-managers were published acknowledging that incorrect calculation models were being applied on purpose and how they intended to change this for the next year, if Eurocontrol requested so. The real numbers actually prove that the productivity of Spanish ATCOs was higher than the European average.

2.3.7.5 The privatisation process also pointed to the alleged poor management carried out by the former president of AENA and the former Government of Spain, which had led to the unnecessary building of non-profitable airports, such as Ciudad Real (with the longest runway in Europe), closed from April 2012, and Castellón, the first airport in the world which was “inaugurated with no airplanes”; as well as unneeded new terminal buildings at regional airports with a ridiculously low number of passengers per year, for instance, León airport or Badajoz airport.

2.3.7.6 Consequences for Spanish ATCOs

2.3.7.6.1 The consequences of the privatisation process in Spain can be divided into two categories: the impact on working and social conditions, and, the effect on professional issues.

2.3.7.6.2 According to Spanish regulation, ATCOs who are working at the control towers to be privatised have three choices open to them: 1) keeping their existing contract with AENA (this involves moving somewhere else), 2) keeping their job position by signing a new contract of employment with the new provider, or 3) terminating their contracts. Theoretically, choosing the second option should not affect their working conditions at all, since the new provider should comply with pre-existing conditions, as it is stated in AENA ́s Collective Agreement, as well as in the Spanish Workers’ Statute.

2.3.7.6.3 In practice, however, most ATCOs have already received a letter explaining the three possible choices, where they are advised that, in case of “being interested” in the second option, they should contact the new company in order to check what their new working conditions will be. It is a fact that the new providers are negotiating working conditions for all new ATCOs individually.

Professionally, we can highlight the following facts affecting ATCOs:

2.3.7.6.3.1 Airspace modification

For the privatised TWRs, and as it occurred for the AFIS, the operational requisites regarding the airspace division and the control responsibility did not come from the National Aviation Authority (DGAC) nor the NSA. It was the Operations Management Department from AENA who took that decision. No stakeholders where consulted.

2.3.7.6.3.2 Training

AENA has approved new unit training plans for the privatised towers which do not comply with the minimum training period of three months for ab-initio air traffic controllers, as stated in ICAO Annex I.

ATCOs working for AENA at those towers have been pressured to become OJTI, even when they had insufficient experience.

In cases where a comprehensive training and assessment of the instructors is not possible, then self-based training is permitted by law (Ministerial Order FOM 1841/2010, Article 26, paragraph 3: “In cases where a comprehensive training and assessment of the instructors in accordance with the provisions of the previous paragraphs is not possible, such provisions may be complemented or replaced by a process of self‐based training, familiarization and simulation of the incoming instructors and examiners, which shall be duly approved or established by the Spanish Air Safety Agency.”).

2.3.7.6.3.3 Lack of independence

In Spain, the ATS competent authority is not independent of the ANSP, as required in Regulation EU 805/2011, Article 21. AENA’s Director of Operations is signing documents as ATS competent authority in Spain, and AESA, the Spanish Safety Supervisory Agency, has in some cases delegated to AENA the issue and renewal of ATCOs licenses.

2.3.8 Commercialization of ATC services in the US: The Us Federal Contract Tower Programme

2.3.8.1 The Federal Contract Tower Programme is a federal funded grant programme to assist qualifying general aviation airports with the Air Traffic Services in Air Traffic Control Towers, which was initiated in 1982 by the Federal Aviation Administration of the U.S. When an airport formally apply to be eligible for this programme, a sponsor application package is sent and the FAA performs a benefit to cost analysis, a formal airspace study and an airspace reclassification if needed, an inspection and evaluation process and a Final Security Assessment.

2.3.8.1.1 The level of service provided by these Contract towers is VFR air traffic control (ATC) services to air carrier, air taxi, military and general aviation users. According to the FAA, the majority of the controllers that staff these facilities were trained by either the FAA or the military.

2.3.8.1.2 A total of 248 airports participate in the programme as of January 1, 2012 and for fiscal year 2012, U.S. Congress approved $117,3 million for FAA ́s fully funded contract tower programme.

2.3.8.1.3 According to the U.S. Contract Tower Association (USCTA), the programme has received positive endorsements from all parties involved, including FAA, the National Transportation Safety Board (NTSB), the Department of Transportation Inspector Geneal, airport management, Congress and the users of the aviation system.

2.3.8.1.4 On the other hand, the National Air Traffic Controllers Association (NATCA) presented “A Review of the FAA ́s Contract Tower Program” before the House Transportation and Infrastructure Subcommittee on Aviation, on July 18, 2012, with a completely different view on the issue. According to that report, NATCA is the exclusive representative of over 15,200 ATCOS serving the FAA and it also represents ATCOs at 63 towers that are part of the Federal Contract Tower Program (FCT). Being a representative of ATCOs working for the contract towers, NATCA claim to be on a unique position to offer an objective assessment and evaluation of similarities and differences between FAA and contract towers.

2.3.8.1.5 As it is stated clearly in the report:

“NATCA supports the cost share component of the FCT program because it enables local communities that couldn’t otherwise support an air traffic control tower to reap the economic benefits aviation brings. NATCA also supports the fact that the contract tower program allows for the building of a new tower where one does not already exist and there is not an FAA presence in the airport. NATCA does not support the expansion of the FCT program to existing FAA towers. By expansion, we mean the transfer or conversion of FAA towers into the FCT program.”

2.3.8.1.6 According to NATCA there is a great difference between both models because since:

“an FAA tower prioritizes safety and relies on redundancy as key to maintaining a safe and efficient air traffic system, contract towers lack redundancy, frequently relying on single controller operation for extended lengths of time, even during busy periods. The FAA requires two controllers on shift. Contract towers, are not bound by that regulation and are free to, and frequently do, staff shifts with only one controller.”

“The FAA sets the minimum staffing for al FAA towers and publishes staffing numbers each year. Contract tower staffing numbers are set between the FAA and the contract company that manages the tower”.

“With reduced staffing, controllers at contract towers are required to divide their time between controlling traffic and performing administrative and supervisory duties. This could include filling out Unsatisfactory Condition Reports (UCR) to report faulty equipment, or administrative duties such as entering traffic counts or changing voice tapes.”

2.3.8.2 Another fundamental issue to underline is that, while:

“the FAA has moved to a true safety culture, where all controllers and employees are encouraged to report all safety issues, including errors, while contract towers are driven by a punitive culture that discourages controllers and their supervisors from reporting errors. NATCA believes that contract towers are understaffed, have less support for their facilities and equipment, and provide insufficient training for their controllers.”

2.3.8.3 However, it is not only about staffing and Just Culture issues that NATCA is worried about: there is also equipment and facility discrepancies, maintenance of equipment discrepancies, and training discrepancies.

2.3.8.3.1 NATCA explains that there is a split set of standards for FAA and contract towers regarding equipment and maintenance of that equipment.

2.3.8.3.2 For example:

“The FAA has a list of the FCT minimum equipment requirements for all FCT towers. In contract towers, only two radio frequencies are required and the emergency frequency is not one of the two. The required backup radios are frequently handheld and have limited range and clarity, not extending past a runway, as compared to a FAA backup radio, which has its own antenna and can have up to a 50-mile range.”

“Contract towers also suffer from sub-par equipment that is old, in poor condition or of poor quality.”

2.3.8.3.3

“The FCT program involves a relationship between the FAA, the tower and the local city or airport authority, which is responsible for equipment maintenance and facility conditions at non-FAA owned facilities. Due to this arrangement between the tower, sponsor and FAA, all three entities often disagree on who is responsible for the cost to repair facilities or equipment, leading to periods of reduced service, or non-existent service. Unlike FAA facilities, contract towers have no on-call maintenance or technicians when equipment, computers or structures need repair”.

2.3.8.3.4 As regard with Training, NATCA states that:

“One of the biggest differences between the FAA and contract tower training processes is the amount of time it takes to certify. Controllers at contract towers are required to train for a mere 30 days before becoming fully certified with the FAA. NATCA believes that the 30-day training period at contract towers is insufficient and results in controllers being given the minimum amount of preparation for working at their new towers. Thirty days is simply not sufficient to train controllers, regardless of experience.”

2.3.8.3.5

“NATCA has been informed that managers are instructed to terminate any controllers who does not certify within the 30 days. Timing is important because when a contract tower hires new controller, it means they replacing someone. As noted earlier, most contract towers begin with bare bones staffing levels, so the loss of one controller is a great concern and training the replacement is of utmost urgency. This approach undermines safety.”

2.3.8.3.6

“NATCA supports the cost-share component of the FCT Program as well as its allowance for building a new tower where one does not already exist. However, NATCA does not support the expansion of the program to existing FAA towers by converting or transferring current towers. NATCA is concerned the FCT Program is pushing the outer limit of safety with bare bones staffing and inadequate support for essential equipment. Contract towers need to provide a better working environment for the controllers who staff them. NATCA represents air traffic controllers at 63 contract towers, and we are proud of the stellar work they do. NATCA made five recommendations for contract tower improvement, including the recommendation that contract towers should be held to the same staffing standards as FAA towers, and that contract towers should model the FAA’s safety culture in allowing controllers to report incidents without fear of punitive retaliation.”

2.3.8.3.7

It is important to emphasise that the program has two clear elements, one is to allow communities to put towers in at airports that do not have enough traffic to warrant an FAA tower. On this case, it is generally an enhancement and will always get positive feedback, since a towered airport is safer than a non-towered airport and will bring more economic activity to an area. On the contrary, it is the contracting out of existing towers, since replacing an existing FAA tower with a contract tower has lower standards for staffing, training and equipment and is generally a degradation.

2.3.9 Africa

2.3.9.1 States where these changes have been introduced include (but not limited to): Nigeria, Ghana, Kenya, Tanzania, Uganda, and South Africa. Other countries are in the process, including Zambia, Zimbabwe, Namibia and Botswana.

2.3.9.2 Most CAAs are not fully private; most of them have become Government- owned partially (Parastatals); even so, there is a common trend in all of them as follows:

- Restructuring processes, involving job evaluations, which are not often carried out by experts in ATS or ANS; the end result is that the ANS staff gets lower ratings than others in the organisation because the majority, apart from engineers, do not hold University degrees. It is important to note that, in this region, University degrees are not often a requisite to become a pilot or an air traffic controller (although this is changing, as more and more employers hire University graduates into these professions).

- New people are employed to take over management positions (so called “new blood” to give the organisation a facelift). These people are not experts in ANS and usually pay no attention to basic facts, especially in general administration and procurements.

- All employees (mainly FLT OPS, airworthiness inspectors and workers of the regulatory department in general) receive appropriate training, except for ATCOs, for whom training is usually not considered necessary. As a result, there is a trend of ATCOs who would rather change jobs to work in other departments within the CAA.

- Promotions are frozen due to ongoing ‘restructuring’.

- ANS staff and controllers working in management positions are now required to hold a Master’s degree or a similar degree to fill management vacancies. As a result, many employees apply to training schools part- time in order to obtain the required degrees. The main consequences are increased fatigue and a greater number of incidents in the airspace.

- Allowances which were previously paid by the Government are withdrawn as ‘evaluations’, in what is often called ‘harmonisation’. Everyone is often given the same that is given to controllers, because the organisation wants to seem ‘fair’ to all staff.

- Working conditions deteriorate and requirements are often “not easily fulfillable”.

- Relationships within the organization get worse because there are two sides: ”the new comers” and the “originals”, which causes a lot of strife and work problems.

- Engineers are given preference because of their degrees, and management or administration positions are usually reserved for them. As an obvious result, serious problems arise.

- All these issues will probably change for the better within around 5 years, when the ANS staff, especially controllers will obtain the necessary degrees and will be able to compete for management posts. This usually happens when they either study or there is an increase in the level of recruitment from high school to University level. After a number of fights and more evaluations done they usually get it right and improve the numeration of controllers for the better, but the fight continues where everyone wants the same even though the work done is different.

Conclusions

3.1 A worldwide trend to transfer Government air navigation services to the private sector can be noticed from the late 80 ́s.

3.2 The Human Capital concept underlines the importance of people as valuable assets within the organization. Therefore, the workforce of ATCOs can be seen as an asset to be valued rather than a cost to be cut.

3.3 IFATCA has policy on privatisation. IFATCA has a neutral position in this matter and has no preferred model.

3.4 The study case of Sweden and Spain shows that the impact of privatisation on the working environment of ATCOs can be very high. During the course of privatisation processes, ATCOs may be exposed to different pressures which not only affect their working conditions but also have an impact on professional issues.

3.5 The existence of efficient and independent safety and economic regulators is a key aspect in regard to ATM privatisation.

Recommendations

4.1 That this paper is accepted as information.

References

ICAO document 9082, Policies on Charges for Airports and Air Navigation Services.

Marc Baumgartner, “Restructuring of Air Navigation Services”, published in the Turkish Air Traffic Controller Association ́s publication “Scope”, October 2003.

“What to expect in privatisation or commercialisation – A guide for MAs”, by PLC. Agenda Item C.6.5, 51st Annual IFATCA Conference – Kathmandu, Nepal, March 2012.

Javier Chicote, ABC newspaper, April 30 2012.

Spanish Ministerial Order FOM 1841/2010.

ERG Assessment of Contestability, CAA, UK, 2008.